Streamline processes, improve efficiency and enhance customer experiences

Banking Process Automation

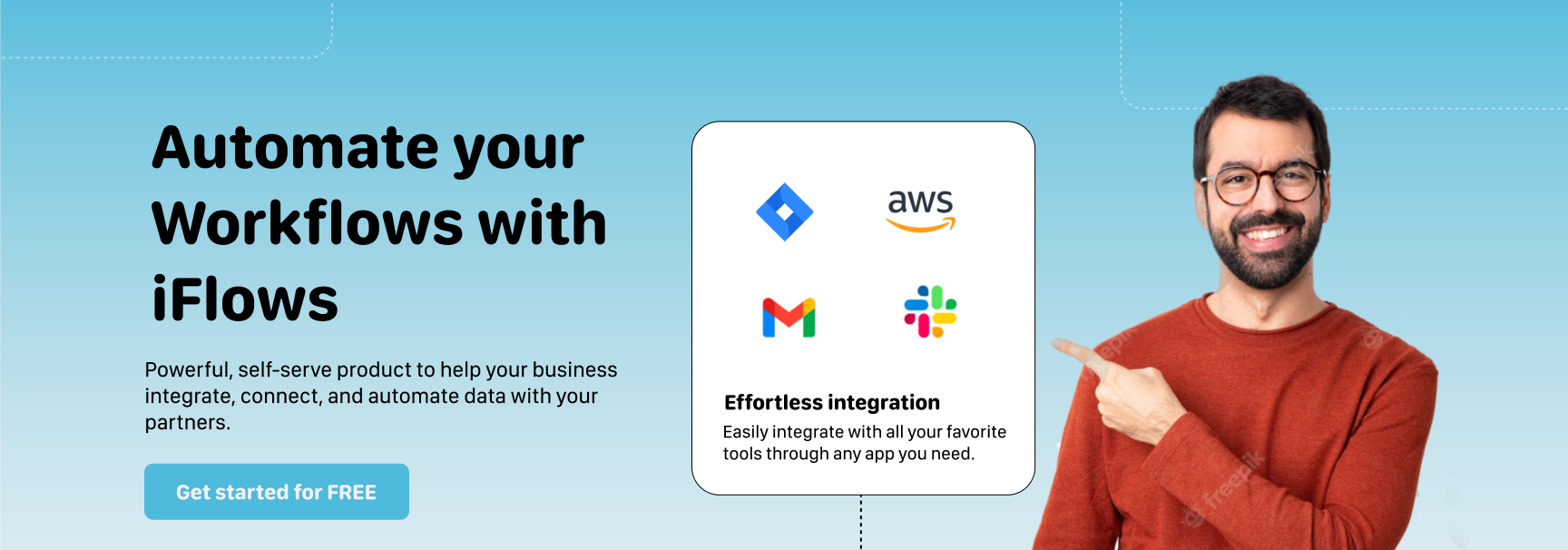

Banks can achieve operational efficiency, reduce manual errors, and provide a more seamless and responsive experience for both customers and internal teams by leveraging iFlows

iFlows empowers banking institutions to respond quickly to changing market demands, improve customer experiences, and ensure compliance with regulatory requirements. iFlows allows for agile and efficient process automation without the need for extensive coding or IT expertise.