Automate various tasks, improve efficiency, and enhance customer experience

Lending services automation

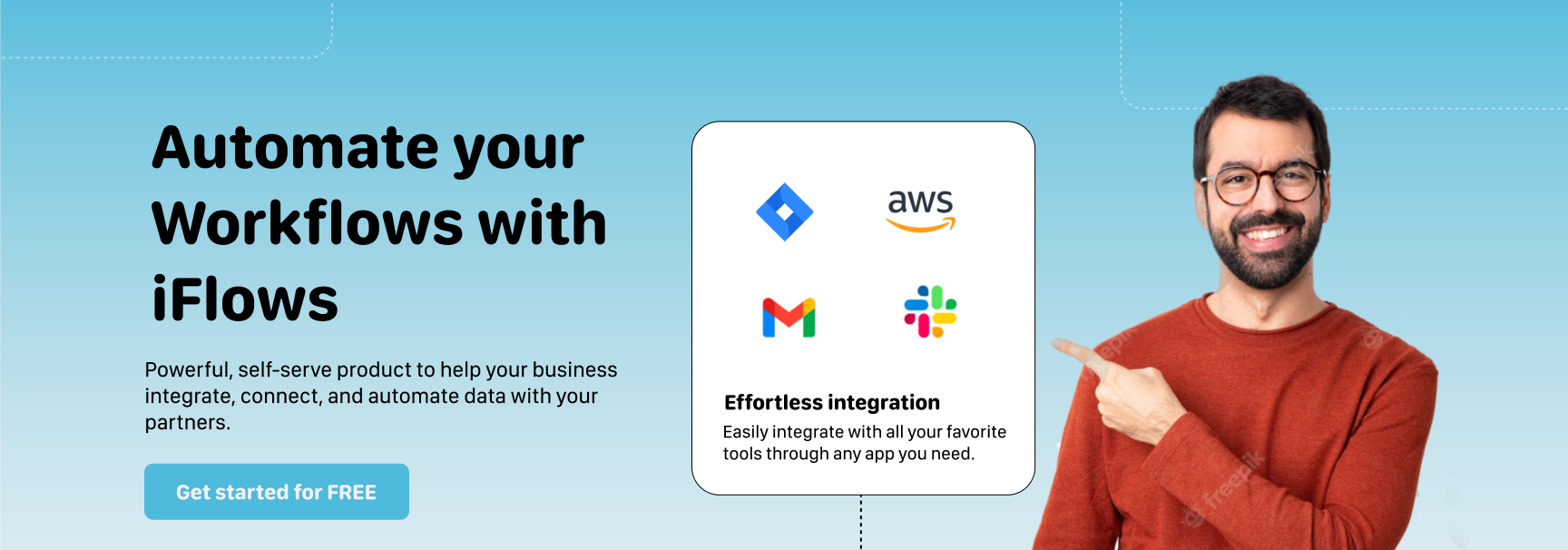

iFlows empowers lending institutions to create, modify, and optimize workflows without extensive coding. iFlows enhances operational efficiency, reduce the risk of errors, and contribute to a more seamless and customer-friendly lending experience.

iFlows enhances lending processes by automating loan origination, credit scoring, document verification, communication with borrowers, and compliance checks. It streamlines operations, improve customer experiences, and ensure regulatory compliance, making lending institutions more efficient and responsive.